16

OctoberIRA Rollover Rules And Your Cash

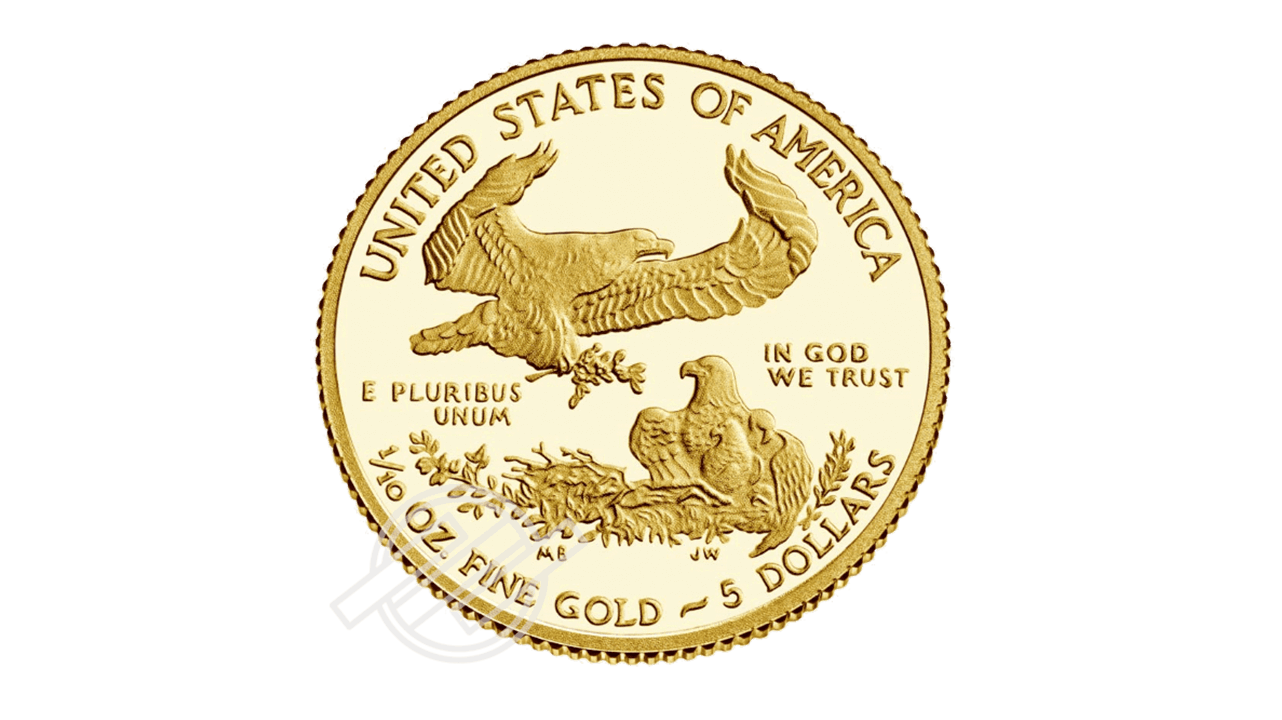

Alternatively, the worth of 24K gold was at ₹6,146 per gram. One key profit is the power to diversify your portfolio with a tangible asset like physical silver. Shopping for real, tangible, physical gold can hedge against potential world monetary market disasters. For those who have any inquiries regarding wherever and how to work with compare gold ira investments, you possibly can call us on the web site. SEP IRAs also offer the pliability of annual contributions, with no requirement to make the identical contribution amount annually. By holding silver in this way, you'll be able to profit from its inherent value as a treasured steel while still enjoying the tax advantages of an IRA. For example, if you contributed $20,000 into your Roth IRA over the years, and it grew to a value of a $2 million by retirement, you possibly can withdraw the whole $2 million for yourself, with out owing any taxes to the IRS. If you happen to personal or inherit IRA bonds, changing into aware of them will enable you benefit from this investment sort and avoid IRS penalties. IRA account holders should be extra meticulous than ever of their IRA transaction proceedings. It serves as a tax-advantaged strategy to put money into varied assets corresponding to stocks, bonds, mutual funds, and more.

Alternatively, the worth of 24K gold was at ₹6,146 per gram. One key profit is the power to diversify your portfolio with a tangible asset like physical silver. Shopping for real, tangible, physical gold can hedge against potential world monetary market disasters. For those who have any inquiries regarding wherever and how to work with compare gold ira investments, you possibly can call us on the web site. SEP IRAs also offer the pliability of annual contributions, with no requirement to make the identical contribution amount annually. By holding silver in this way, you'll be able to profit from its inherent value as a treasured steel while still enjoying the tax advantages of an IRA. For example, if you contributed $20,000 into your Roth IRA over the years, and it grew to a value of a $2 million by retirement, you possibly can withdraw the whole $2 million for yourself, with out owing any taxes to the IRS. If you happen to personal or inherit IRA bonds, changing into aware of them will enable you benefit from this investment sort and avoid IRS penalties. IRA account holders should be extra meticulous than ever of their IRA transaction proceedings. It serves as a tax-advantaged strategy to put money into varied assets corresponding to stocks, bonds, mutual funds, and more.

• Distributions of metals or other assets owned by the LLC should go first to the IRA supplier to be reported to the IRS. CosmosUPS also explains the components that it used to evaluate completely different crypto IRA suppliers, and that traders ought to consider when selecting a provider. • The IRA proprietor should supply the IRA provider with third celebration affirmation of the worth of the LLC including any metals and any cash it owns. Moreover, though bars are the purest form of physical gold or silver, they are nonetheless value-added, formed merchandise with a markup over melt worth and seller-specific charges or prices (transport, storage, insurance coverage, etc). A non-public loan’s value can be dependent on the lender’s threat tolerance, as outlined within the loan’s agreed-upon interest price and maturity date. Interest accrues, which means it's added to the principal of the bond.

• Distributions of metals or other assets owned by the LLC should go first to the IRA supplier to be reported to the IRS. CosmosUPS also explains the components that it used to evaluate completely different crypto IRA suppliers, and that traders ought to consider when selecting a provider. • The IRA proprietor should supply the IRA provider with third celebration affirmation of the worth of the LLC including any metals and any cash it owns. Moreover, though bars are the purest form of physical gold or silver, they are nonetheless value-added, formed merchandise with a markup over melt worth and seller-specific charges or prices (transport, storage, insurance coverage, etc). A non-public loan’s value can be dependent on the lender’s threat tolerance, as outlined within the loan’s agreed-upon interest price and maturity date. Interest accrues, which means it's added to the principal of the bond.

The interest earnings are usually not taxable until an IRA bond is redeemed. When you attain the age of 73, you are required to start withdrawing a specific amount out of your IRA annually. However, the money in the Roth IRA grows tax-free, and qualified withdrawals are made tax-free as well. In case your beneficiary is younger sufficient, the Roth IRA probably can provide many years of tax free progress. To have the ability to make the total contribution right into a Roth IRA for 2024, your earnings have to be under $146,000. If your MAGI is over $146,000 however lower than $161,000, your contribution restrict gets reduced. If your MAGI is over $138,000 however less than $153,000, your contribution restrict gets diminished. There is no early distribution penalty for contribution withdrawals, and because you already paid earnings taxes in your contribution, you won’t owe any extra taxes on when withdrawing from the plan. Potential for tax-free compounding over a number of many years. One of the primary advantages of an individual Retirement Account (IRA) is its accessibility and ease of setup.

Reviews