13

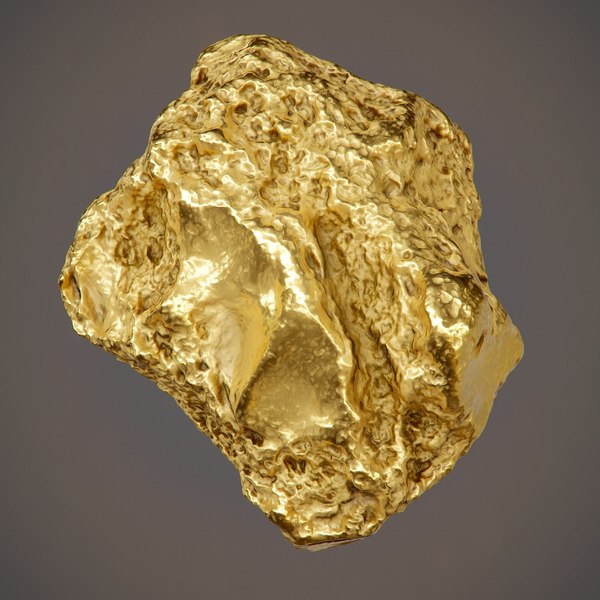

NovemberGold IRA Companies Assessment 2024

Gold can be scattered along the ocean flooring, but is also thought of uneconomic to mine. Please search for companies with educated employees who can answer questions shortly and accurately. Extra treasured metal investments opportunities were rendered obtainable as a result of Taxpayer Relief Act of 1997. This enlarged the list of allowable treasured metals within an IRA, introducing palladium and platinum to the mix. Now let’s take a more in-depth have a look at whether or not there are any charges associated with having a Gold IRA. Nevertheless, some buyers may find their product vary more limited in comparison with other corporations. If you treasured this article and you would like to collect more info relating to reliable companies for Ira in gold i implore you to visit the web site. Gold IRAs include storage and insurance costs, restricted access to funds, and doubtlessly lower returns compared to other funding autos, making them a much less fascinating choice for a lot of buyers. There are various benefits of converting your IRA into something that invests in coins or bars of gold including defending your self from market volatility, diversifying your portfolio and even gaining access to tangible assets. This is based on a comprehensive analysis, together with an editorial score of 4.6 out of 5. It is the very best-rated gold IRA company that provides access to platinum and palladium coins and bars. In the next sections, we’ll provide an outline of every company and their choices. Custodians normally cost an annual upkeep payment of $seventy five to $300.

Gold can be scattered along the ocean flooring, but is also thought of uneconomic to mine. Please search for companies with educated employees who can answer questions shortly and accurately. Extra treasured metal investments opportunities were rendered obtainable as a result of Taxpayer Relief Act of 1997. This enlarged the list of allowable treasured metals within an IRA, introducing palladium and platinum to the mix. Now let’s take a more in-depth have a look at whether or not there are any charges associated with having a Gold IRA. Nevertheless, some buyers may find their product vary more limited in comparison with other corporations. If you treasured this article and you would like to collect more info relating to reliable companies for Ira in gold i implore you to visit the web site. Gold IRAs include storage and insurance costs, restricted access to funds, and doubtlessly lower returns compared to other funding autos, making them a much less fascinating choice for a lot of buyers. There are various benefits of converting your IRA into something that invests in coins or bars of gold including defending your self from market volatility, diversifying your portfolio and even gaining access to tangible assets. This is based on a comprehensive analysis, together with an editorial score of 4.6 out of 5. It is the very best-rated gold IRA company that provides access to platinum and palladium coins and bars. In the next sections, we’ll provide an outline of every company and their choices. Custodians normally cost an annual upkeep payment of $seventy five to $300.

A: The interior Revenue Service specifically prohibits people from utilizing such annual distributions-which are required when you reach age 70½-as earnings from which to fund a Roth IRA. Withdrawals before the age of 59.5 could incur penalties, and the kind of IRA (e.g., Traditional vs. At age 72, accountholders must start taking required minimum distributions, known as RMDs. These must meet their respective minimum fineness necessities, and in sure circumstances, be produced by a refiner, assayer, or accredited producer, or possess a nationwide government mint. After selecting which sort fits your needs finest, you may have to deposit the money into your account and buy the steel itself. No matter what kind of gold investment you choose, doing analysis earlier than jumping into something is at all times advisable. This may be accomplished through a course of known as "custodian to custodian transfer" which strikes money between two completely different financial institutions without taxes or penalties being applied. With regards to investing in gold and silver, one among the largest decisions you'll have to make is whether to transfer or rollover an IRA.

A: The interior Revenue Service specifically prohibits people from utilizing such annual distributions-which are required when you reach age 70½-as earnings from which to fund a Roth IRA. Withdrawals before the age of 59.5 could incur penalties, and the kind of IRA (e.g., Traditional vs. At age 72, accountholders must start taking required minimum distributions, known as RMDs. These must meet their respective minimum fineness necessities, and in sure circumstances, be produced by a refiner, assayer, or accredited producer, or possess a nationwide government mint. After selecting which sort fits your needs finest, you may have to deposit the money into your account and buy the steel itself. No matter what kind of gold investment you choose, doing analysis earlier than jumping into something is at all times advisable. This may be accomplished through a course of known as "custodian to custodian transfer" which strikes money between two completely different financial institutions without taxes or penalties being applied. With regards to investing in gold and silver, one among the largest decisions you'll have to make is whether to transfer or rollover an IRA.

To do that, you must first open a gold rollover with either a treasured metals seller or self-directed IRA custodian. Apart from this, there's a limited supply of precious metals obtainable to acquire. These metals are predictably gold, alongside silver, platinum, and palladium. Fineness necessities aren’t the only valuable steel attributes to think about. With consciousness of fineness requirements and the specificities of the coins and bars allowed in a Gold IRA, you might possibly secure a stream of supplemental revenue on your retirement. 3. Seek the advice of a monetary advisor that can assist you understand RMD rules and maintain compliance with all IRS requirements. Compliance with rules concerning measurement, weight, design, and metal purity is necessary when buying IRA gold coins and bars. The custodian's job is to ensure compliance with IRS rules and regulations, making their expertise and reliability paramount for the investor. Their experience within the business has earned them recognition as one of the premier precious metals IRA companies in the United States. A monetary advisor with experience in these areas can present invaluable insights, permitting you to make informed decisions and maximize the advantages from the switch. If so, a gold IRA transfer may be the reply you’re looking for.

Reviews