19

DecemberFTSE a hundred Rises On Back Of BT And Gold Mining

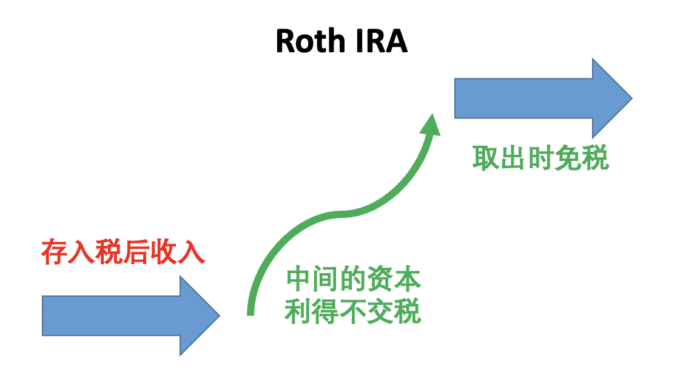

Investing in gold within a precious metals IRA can be advantageous for the retirement investor in multiple ways. Research and find the best funding strategy in your distinctive monetary state of affairs. Roth IRAs: Certified withdrawals are tax-free, and there are not any RMDs. For Gold IRAs, RMDs are based mostly on the account’s whole worth, which might embody numerous valuable metals like gold coins, silver, and platinum. However, not all gold bars and coins are eligible to be used as investments in an IRA, as the internal Revenue Service (IRS) has set forth very specific requirements and purity standards concerning the types of gold allowed an IRA. If you beloved this write-up and you would like to get more information concerning affordable options for ira gold investments (www.alkhazana.net) kindly pay a visit to our website. And your dedicated IRA staff member will work straight with you to ensure that the proper process is followed to make sure that we safely and securely rollover money between retirement accounts in such a approach that does not incur any sort of taxes or penalties. In order to stay free from potential taxes and penalties, the money must be transferred within 60 days from the retirement account from which you are funding your gold IRA into your gold IRA account. Sadly, in case your IRA account is invested in stocks, mutual funds, ETFs, bonds (or other conventional funding vehicles), then it is very unlikely that your current IRA supplier is in a position or prepared to manage a bodily asset resembling valuable metals.

Investing in gold within a precious metals IRA can be advantageous for the retirement investor in multiple ways. Research and find the best funding strategy in your distinctive monetary state of affairs. Roth IRAs: Certified withdrawals are tax-free, and there are not any RMDs. For Gold IRAs, RMDs are based mostly on the account’s whole worth, which might embody numerous valuable metals like gold coins, silver, and platinum. However, not all gold bars and coins are eligible to be used as investments in an IRA, as the internal Revenue Service (IRS) has set forth very specific requirements and purity standards concerning the types of gold allowed an IRA. If you beloved this write-up and you would like to get more information concerning affordable options for ira gold investments (www.alkhazana.net) kindly pay a visit to our website. And your dedicated IRA staff member will work straight with you to ensure that the proper process is followed to make sure that we safely and securely rollover money between retirement accounts in such a approach that does not incur any sort of taxes or penalties. In order to stay free from potential taxes and penalties, the money must be transferred within 60 days from the retirement account from which you are funding your gold IRA into your gold IRA account. Sadly, in case your IRA account is invested in stocks, mutual funds, ETFs, bonds (or other conventional funding vehicles), then it is very unlikely that your current IRA supplier is in a position or prepared to manage a bodily asset resembling valuable metals.

The trustee-to-trustee process moves your retirement monies from your current IRA provider straight into the arms of your new Precious Metals IRA provider. Assessing gold IRA company ratings is crucial in selecting a trustworthy supplier. Opening a self-directed IRA permits you to spend money on gold whereas working with a reputable broker, custodian, and storage supplier to ensure your investment is secure. Safe storage is vital for protecting your gold IRA assets. The Delaware Depository offers a formidable, complete insurance coverage policy, underwritten by London Underwriters, one of many world's oldest insurance suppliers. We can arrange for the metals to be securely shipped from The Delaware Depository's depository, or we will enable you liquidate your metals in change for cash.

The trustee-to-trustee process moves your retirement monies from your current IRA provider straight into the arms of your new Precious Metals IRA provider. Assessing gold IRA company ratings is crucial in selecting a trustworthy supplier. Opening a self-directed IRA permits you to spend money on gold whereas working with a reputable broker, custodian, and storage supplier to ensure your investment is secure. Safe storage is vital for protecting your gold IRA assets. The Delaware Depository offers a formidable, complete insurance coverage policy, underwritten by London Underwriters, one of many world's oldest insurance suppliers. We can arrange for the metals to be securely shipped from The Delaware Depository's depository, or we will enable you liquidate your metals in change for cash.

Every client account on the Delaware Depository is 100% insured for the full value of the metals saved. Nonetheless, it’s essential to understand that investing in a Precious Metals IRA includes certain fees, similar to seller’s fees, storage fees, and presumably management fees, which might range from one financial institution or broker-supplier to another. There are two safe, tax-free and penalty-free methods used to switch cash between retirement accounts: the direct trustee-to-trustee switch and the 60-day rollover option. Among the extra common IRA approved bullion coins are American Gold Eagles, American Silver Eagles, Canadian Maple Leaves, and Austrian Philharmonics. Canadian Conflict of 1812 Gold Coin - The Royal Canadian Mint ensures each the burden and purity of those extremely restricted editions commemorative coins issued on the bicentennial of the Conflict of 1812. These coins are available sheets of 20 instantly from the Royal Canadian Mint or in singles. For gold to be eligible, it must have a purity of 99.5% or larger. SEP and Easy IRAs are choices for self-employed individuals or small enterprise homeowners, offering tax deferral advantages on contributions. Certified retirement accounts embody: Roth, SEP or a Easy IRA, 401k, 403b, 457b, Pension plans, or Thrift Financial savings accounts.

We'll help you with filling out a easy IRA software to open your Precious Metals IRA account. For those able to take motion, learning the right way to open a gold IRA and the nuances of a 401k to gold IRA rollover can provide the wanted readability. It takes solely 1 enterprise day to course of your distribution and the funds can be sent out instantly! It usually takes between 1 and 3 weeks. Lear's IRA Division has efficiently processed over $1 Billion of IRA transactions and you'll relaxation assured your IRA staff member will help you step-by-step via your complete process. We all know this rollover process can seem sophisticated and we urge our clients to allow us to do the heavy lifting! Knowing these revenue limits helps determine whether a Roth Gold IRA, which includes precious metals like silver, is appropriate to your financial situation, attracting certified traders. Most suppliers have an account minimal for opening a gold IRA- it may well range from $5000 to $50,000- so make sure you pick one which works to your funds. Transaction charges and delivery costs which might be added to every buy aren't included right here. If we can't match or beat the worth, you possibly can cancel your transaction with us for gratis to you.

Reviews